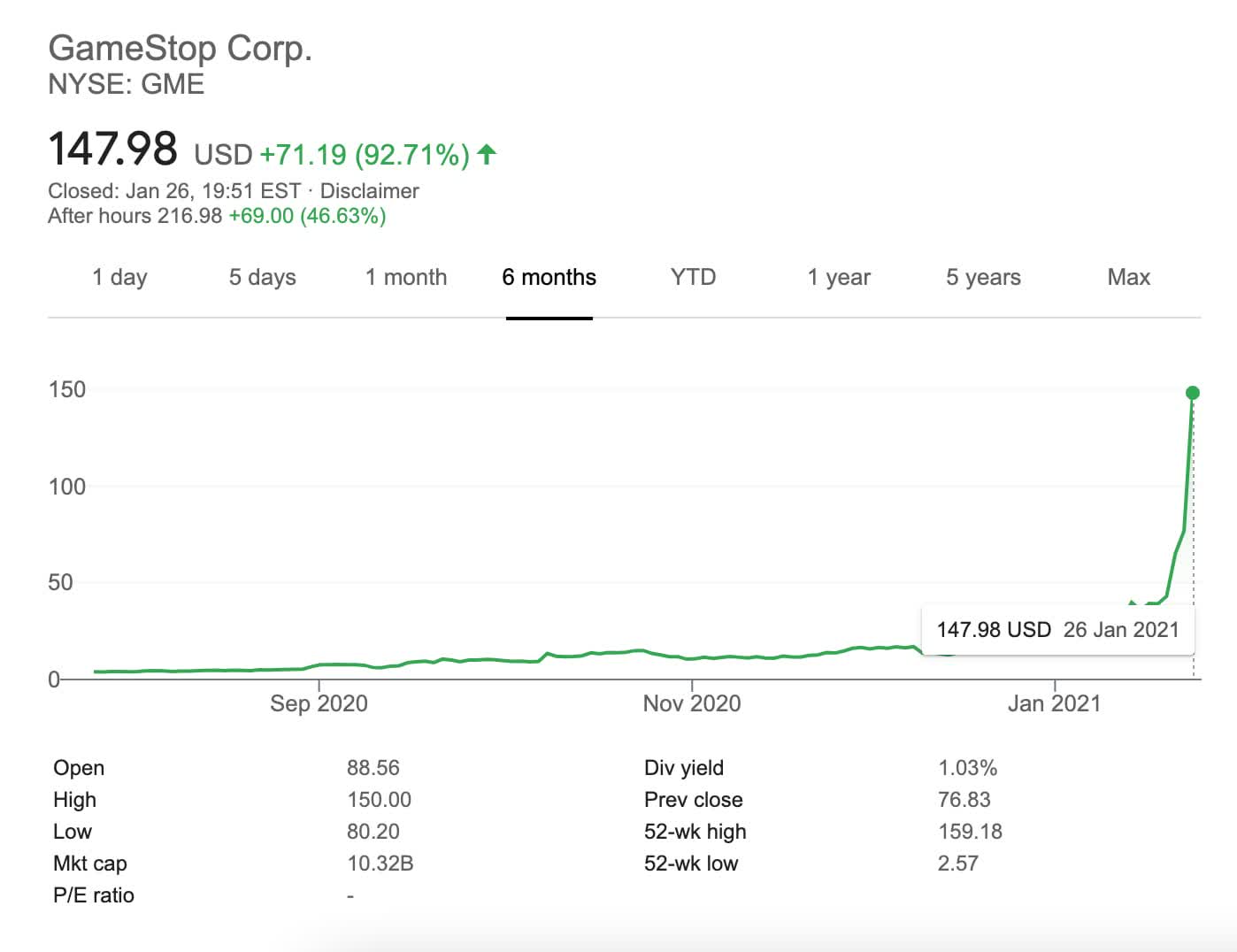

So please explain to me what shorting a stock is At the same time, a number of big Wall Street financial players bet against GameStop and shorted the stock. Small-time investors purchased what they saw as undervalued GameStop stock using the Robinhood mobile app and other new trading services that aim to democratise market access. The stock’s surge has created $2bn in personal wealth for the firm’s three largest individual shareholders, including Cohen – none of whom appear to have sold their shares yet. During the past week, its value has catapulted past $300 per share, reaching a peak of $373 on Wednesday morning in New York. How much is GameStop now worth?īy mid-January, the stock had surpassed $30 per share. That was when the firm’s cult-like status began to emerge. The stock then slowly recovered by the end of the northern hemisphere summer and in September, investor Ryan Cohen rallied around the retailer, pressing for the company to take on Inc.Ĭohen snatched up a 13 percent stake in GameStop and along with two partners, jumped onto the company’s board. In April 2020, Gamestop announced plans to close 450 stores.

Gamestop share price free#

Yet now, the gaming merchandiser is taking a victory lap, just as other companies have also seen their fortunes brought back to life by so-called “Reddit rich” rookies exchanging free stock tips on the social media site. Struggling to shift from brick-and-mortar stores to an online seller, the company was shuttering many of its mall shops. The coronavirus pandemic had slammed the Texas-based chain with more than 5,500 retail locations. Virtually overnight, the value of GameStop went from extraordinarily low to breathtakingly high. An unlikely company has found itself at the centre of a much-heralded sea change in investment trends, as video game retailer GameStop’s stock continues to skyrocket – at least for now.īut the bizarre spectacle around the surge in the US consumer electronics firm’s share price has become a war of words – and dollars – between traditional Wall Street barons and small-time retail investors catalysed by social-media buzz.

0 kommentar(er)

0 kommentar(er)